Siltronic Transaction

- Transaction Summary

- Related News

- Siltronic Overview

- Transaction Rationale

- Announcements and Other Information

| Target | ▸ Siltronic AG (Siltronic) |

| Valuation & Premium | ▸ EUR145 in cash / Siltronic share ▸ 71% premium to 90 day VWAP of EUR84.59 before Nov 27, 2020 ▸ 28% premium to closing price of EUR113.55 on Nov 27, 2020 |

| Acquisition Method | ▸ Voluntary Takeover Offer |

| Financing | ▸ Acquisition funded using existing cash on hand and committed acquisition financing |

| Acceptance Level | ▸ Minimum acceptance level of 50% ▸ Final acceptance level : 70.27% |

| Current Progress | GlobalWafers Co., Ltd. has now obtained merger control clearance regarding its all-cash tender offer for the outstanding ordinary shares of Siltronic AG (“Siltronic”) from the State Administration for Market Regulation of the People’s Republic of China. This approval follows clearances already received from the German Federal Cartel Office, the Austrian Federal Competition Authority, the Korea Fair Trade Commission, the Taiwan Fair Trade Commission, the Competition and Consumer Commission of Singapore, under the U.S. Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, the Japan Fair Trade Commission, and the Committee on Foreign Investment in the United States. ▸ Milestone of Siltronic Transaction |

Company Overview

▸ Established in 1968 and headquartered in Munich, Germany, and supplier to all top silicon wafer consumers

–Top 10 customers represent c.80% of 2019 revenue

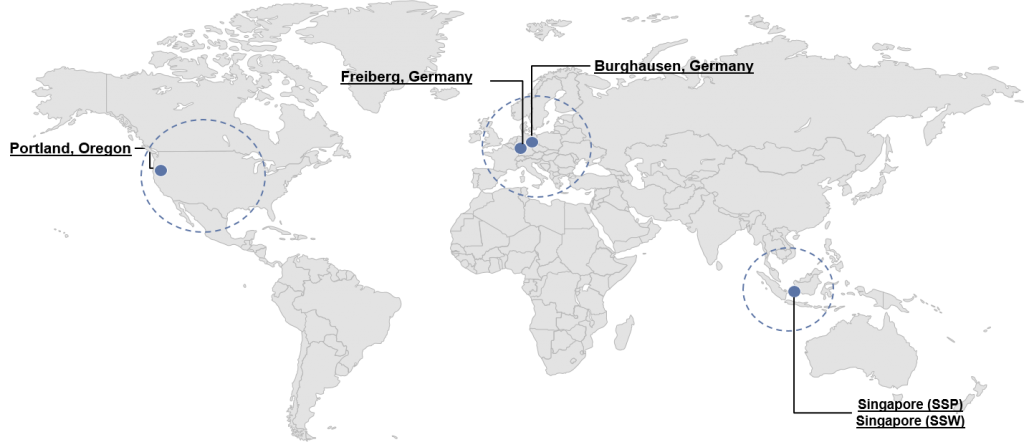

▸ State-of-the-art production facilities in Europe, Asia and the USA, and c.3,800 employees*

–Central R&D hub in Burghausen

–High volume facilities in Germany and Singapore

▸ Largest shareholder is Wacker Chemie AG (30.8% stake)

*As of Jun 30, 2020

Company History

Production Facilities Overview

Material Announcements

Germany Local Announcement

GlobalWafers confirms advanced, near to final discussions on a takeover offer of Siltronic AG with BCA to be signed upon the Board approval of both parties (2020-11-30)

GlobalWafers Co., Ltd. (”GlobalWafers”), today confirms the November 29, 2020 disclosure by Siltronic AG (”Siltronic”) that GlobalWafers and Siltronic are in advanced, near to final discussions to enter into a Business Combination Agreement (”BCA”) pursuant to which GlobalWafers would launch a voluntary tender offer to Siltronic shareholders with an offer price of EUR 125 per share. In line with Siltronic’s dividend policy, Siltronic’s Executive Board also intends to propose a dividend of approximately EUR 2 per share to Siltronic shareholders for fiscal year 2020, which is expected to be paid prior to the completion of the transaction.

Announcement on the board approval for the acquisition of Siltronic (2020-12-10)

The proposal was submitted to GWC Board dated Dec-9, 2020 with approval by all directors presented at the meeting and none voiced an objection. GlobalWafers GmbH, a 100% owned subsidiary of GlobalWafers, will proceed the transaction per the aforementioned terms and conditions. 2.The Company and its subsidiaries hold total 4.167% of outstanding shares of the target company

GWC officially published the offer document for acquiring Siltronic with BaFin approval (2020-12-21)

Pursuant to the Business Combination Agreement entered into between GlobalWafers Co., Ltd. (GlobalWafers) and

Siltronic AG (Siltronic) as disclosed on December 10, 2020, and following approved by the German Federal Financial

Supervisory Authority (BaFin), GlobalWafers on December 21, 2020 9 AM German time (4 PM Taiwan time) officially

published the Offer Document outlining terms of the voluntary public takeover offer for the acquisitions of all no-par

value registered shares in Siltronic. The acceptance period for the offer period will commence on December 21, 2020

and end on January 27, 2021.

The Offer Document and a non-binding English translation will be available from today, free of charge, at BNP Paribas

Securities Services S.C.A. Zweigniederlassung Frankfurt, Europa-Allee 12, 60327 Frankfurt, Germany (order by fax at

+49 69 1520 5277 or by e-mail at frankfurt.gct.operations@bnpparibas.com), or on the internet

at www.offer-globalwafers-siltronic.com.GlobalWafers revises offer for Siltronic to EUR 140 per share (2021-01-22)

The Company and its subsidiaries currently hold a cumulative stake of 4.53% of Siltronic's outstanding shares

from market purchases.GlobalWafers revises offer for Siltronic to EUR 145 per share (2021-01-23)

The Company and its subsidiaries currently hold a cumulative stake of 6.06% of Siltronic's outstanding shares from

market purchases.

GlobalWafers lowers acceptance threshold for Siltronic offer to 50% (2021-01-25)

The Company and its subsidiaries currently hold a cumulative stake of 6.06% of Siltronic's outstanding shares from

market purchases.

GWC announces start of additional acceptance period of takeover offer for Siltronic in reaching the minimum acceptance level in the offer period (2021-02-15)

GlobalWafers’s subsidiary, GlobalWafers GmbH (”Bidder”), has started the additional acceptance period in context of its all-cash takeover offer for all outstanding ordinary shares of Siltronic AG (”Siltronic”). The additional acceptance period is due to run from 16 February 2021 until 1 March 2021, 24.00 hours local time in Frankfurt am Main. During the main offer period between 21 December 2020 and 10 February 2021, GlobalWafers has achieved an acceptance level of 56.92%, surpassing the minimum acceptance threshold of 50%. GlobalWafers encourages all Siltronic shareholders which have not already done so during the main offer period to tender their Siltronic shares into the offer during the additional acceptance period until 1 March 2021, 24.00 local time in Frankfurt am Main. The final results of the offer will be published after the end of the additional acceptance period. GlobalWafers and its subsidiaries currently hold a cumulative stake of 13.67% of Siltronic’s outstanding shares from market purchases (this shareholding percentage is included in the calculation of aforementioned acceptance level of 56.92%).

GWC announces final result of takeover offer for Siltronic – Additional acceptance period ended on 2021/3/1 with a final acceptance level of 70.27% (2021-03-04)

GlobalWafers today announces that following the end of the additional acceptance period regarding its all-cash tender offer for the outstanding ordinary shares of Siltronic AG (“Siltronic”), its subsidiary GlobalWafers GmbH (“Bidder”) has achieved a final acceptance level of 70.27%. The closing of the offer remains subject to receipt of regulatory approvals.

GlobalWafers continues to expect the closing of the transaction in the second half of 2021.

GlobalWafers and its subsidiaries currently hold a cumulative stake of 13.67% of Siltronic’s outstanding shares from market purchases (this shareholding percentage is included in the calculation of aforementioned acceptance level of 70.27%).

Update on Approvals for GlobalWafers’ Acquisition of Siltronic (2021-10-22)

GlobalWafers continues to actively work toward satisfying the regulatory conditions in its all-cash tender offer for the outstanding ordinary shares of Siltronic AG (“Siltronic”).

GlobalWafers has already cleared the requirements of the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, and has received approvals from the Competition and Consumer Commission of Singapore, the German Federal Cartel Office, the Austrian Federal Competition Authority, the Korea Fair Trade Commission, the Taiwan Fair Trade Commission, and the Committee on Foreign Investment in the United States in the United States.

Despite complex regulatory processes, GlobalWafers is making constructive progress toward the acquisition of Siltronic with the objective of closing before the end of 2021.

Related Documents

Announcement Pursuant to Section 23 Para. 1 Sentence 1 No. 3 of the German Securities Acquisition and Takeover Act (wertpapiererwerbs- und übernahmegesetz – “wpüg”)

Announcement Pursuant to Section 23 Para. 1 Sent. 1 No. 2 of the Qerman Securities Acquisition and takeover act (wertpapiererwerbs- und übernahmegesetz – “wpüg”) and Regarding the Fulfillment of Completion Conditions

Announcement Regarding the Fulfillment of a Completion Condition

Notification Pursuant to Sec. 10, Para. 1 wpüg

→ Dec 9, 2020 (English Version)

→ Dec 9, 2020 (German Version)