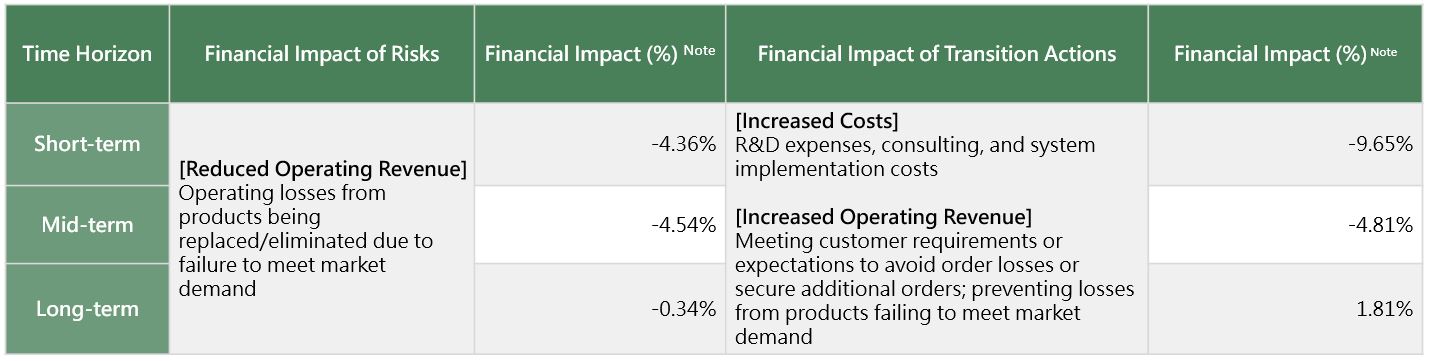

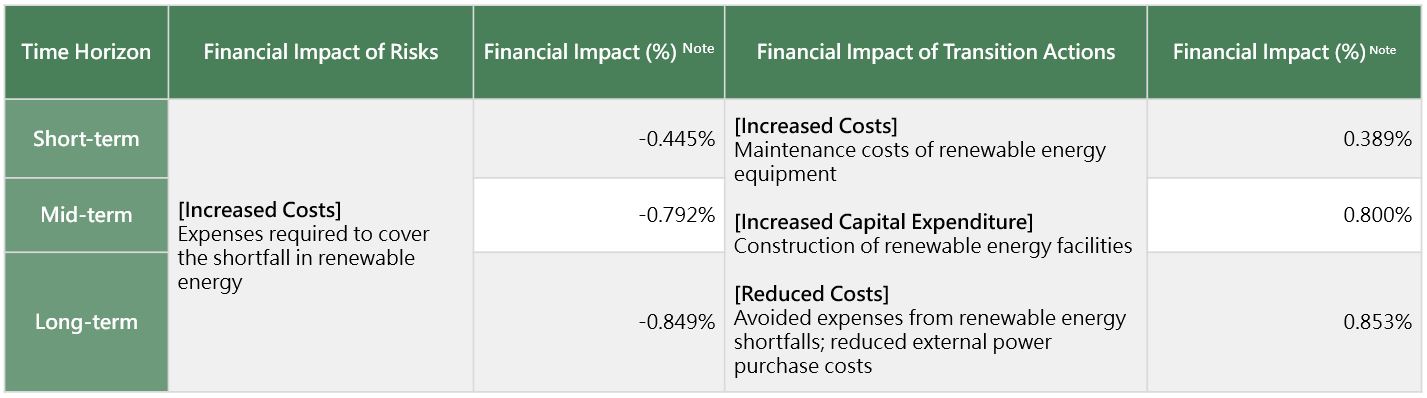

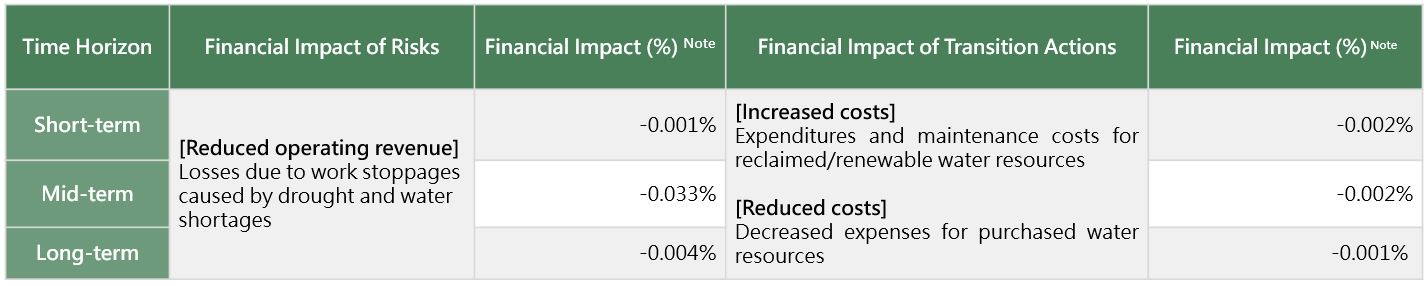

Note: Figures represent the ratio of financial impacts from risks/transition actions to annual revenue.

Task Force on Climate Related Financial Disclosures (TCFD)

Climate Strategy and Actions

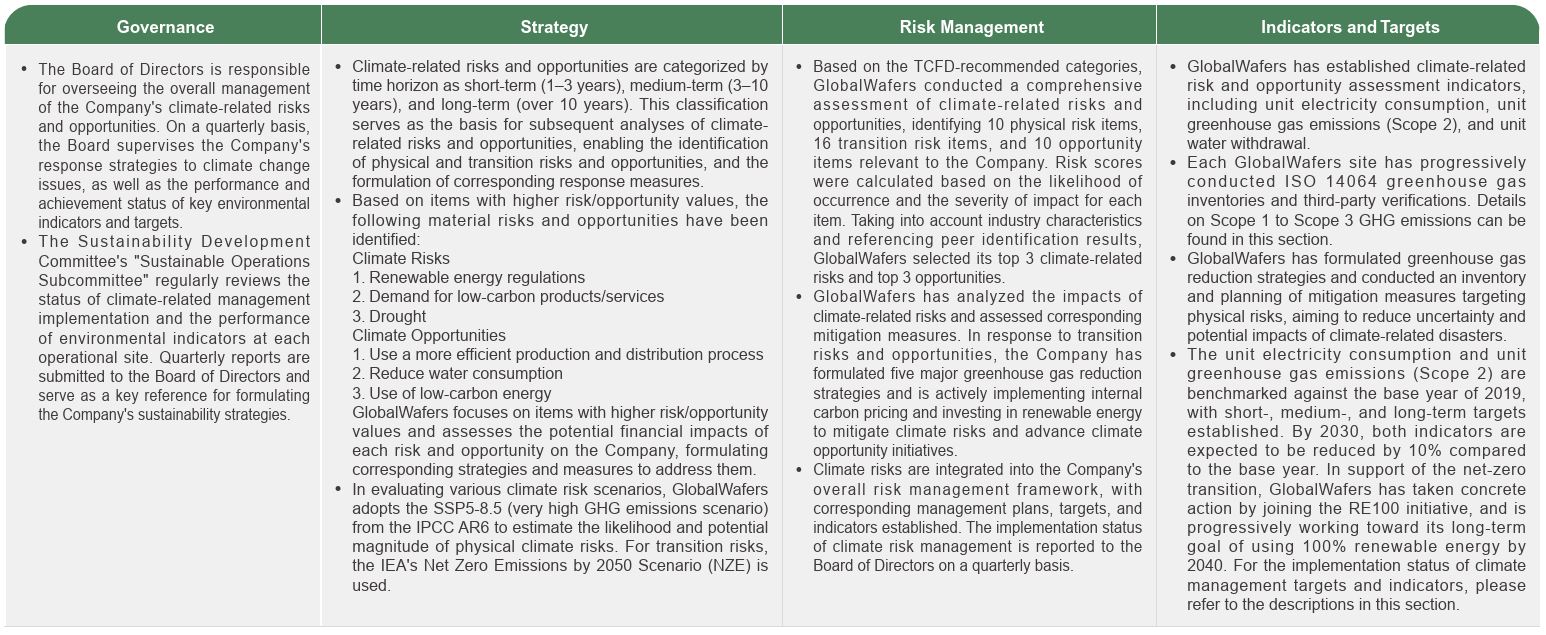

Climate change is currently one of the most pressing environmental issues, drawing significant attention from the United Nations, governments worldwide, society, and the business community. To support the public and private sectors in developing relevant disclosure practices, the Financial Stability Board (FSB) established the Task Force on Climate-related Financial Disclosures (TCFD), which issued a set of clear, comparable, and consistent recommendations for climate-related financial disclosures in June 2017. GlobalWafers follows the key pillars of the Financial Supervisory Commission’s “Sustainable Development Roadmap for TWSE/TPEx Listed Companies” and “Sustainable Development Action Plans for TWSE/TPEx Listed Companies,” and references the TCFD framework to enhance the disclosure of sustainability information in its sustainability report. The Company identifies and evaluates climate change-related risks and opportunities on an annual basis, ensuring timely review and updates. Disclosures on climate change-related information are made based on the four core elements of governance, strategy, risk management, and indicators and targets.

Governance Framework and Roles & Responsibilities

The Company has established a “Risk Management Policy and Procedures,” with the Board of Directors serving as the highest governing body for risk management. The Audit Committee assists in overseeing matters related to risk management. Regarding climate change issues, the Board of Directors is responsible for supervising the development strategies, short-, medium-, and long-term targets, and overall management of climate-related risks and opportunities. The Board also provides guidance and feedback on these matters. Given the significance and unique nature of climate change, the Board additionally conducts quarterly oversight of the Company’s response strategies, the performance of key environmental indicators, and progress toward related targets. In addition to incorporating climate issues into corporate governance and business strategies, the Board integrates the management of climate risks and opportunities into the Company’s overall policies. Through continuous monitoring of the implementation of various risk management mechanisms, the Board aims to ensure that while the business continues to grow, climate change management practices are also effectively carried out, underscoring the Company’s commitment to climate governance.

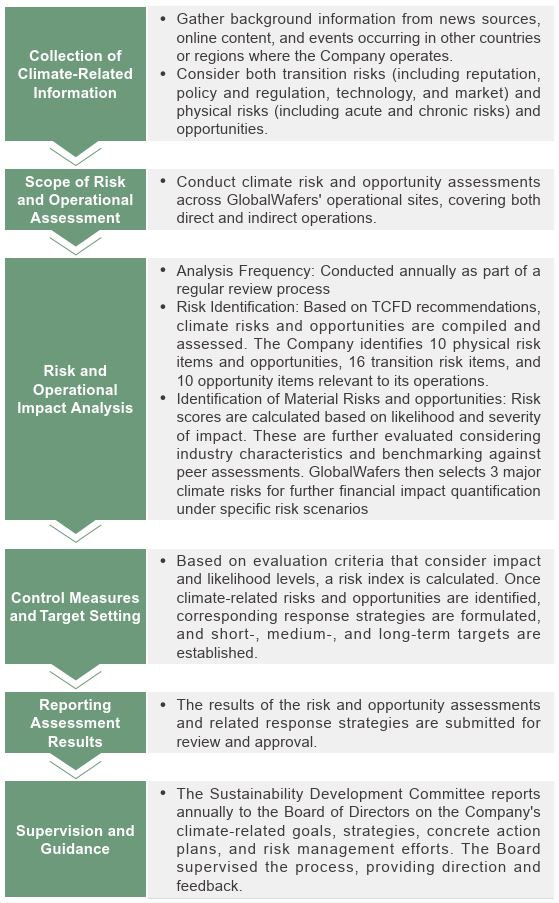

Identification and Assessment of Climate Risks and Opportunities

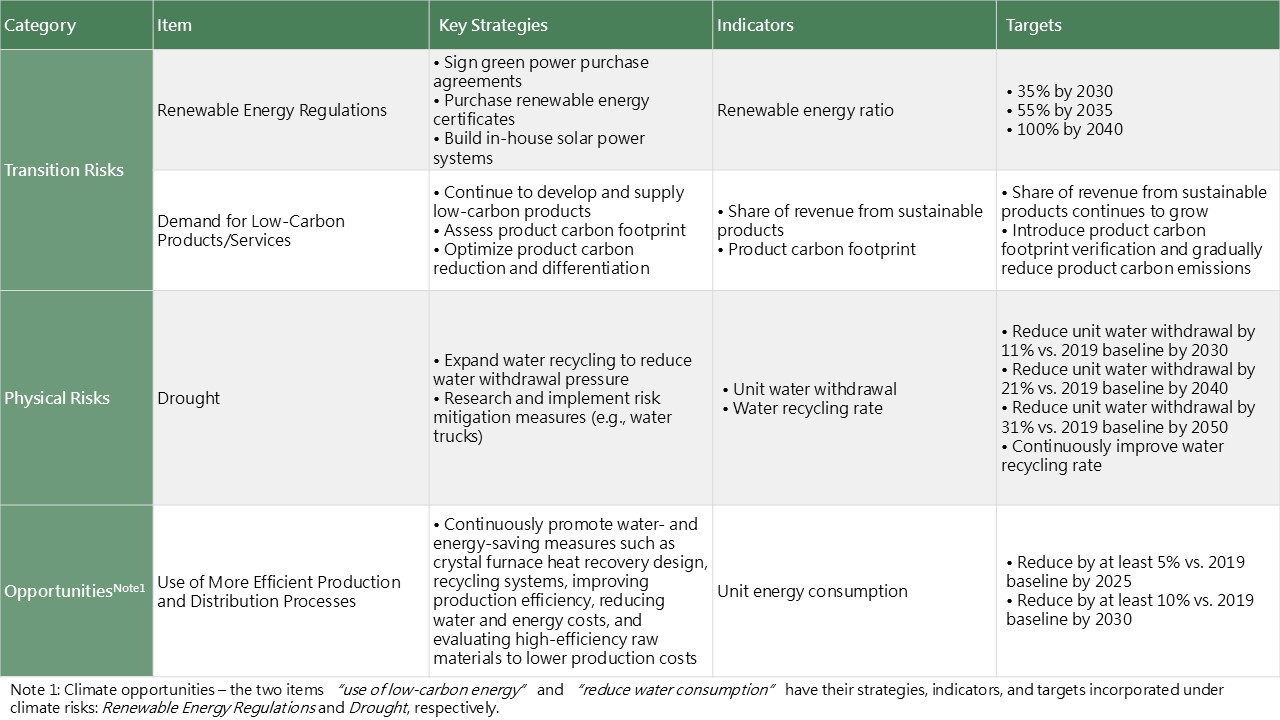

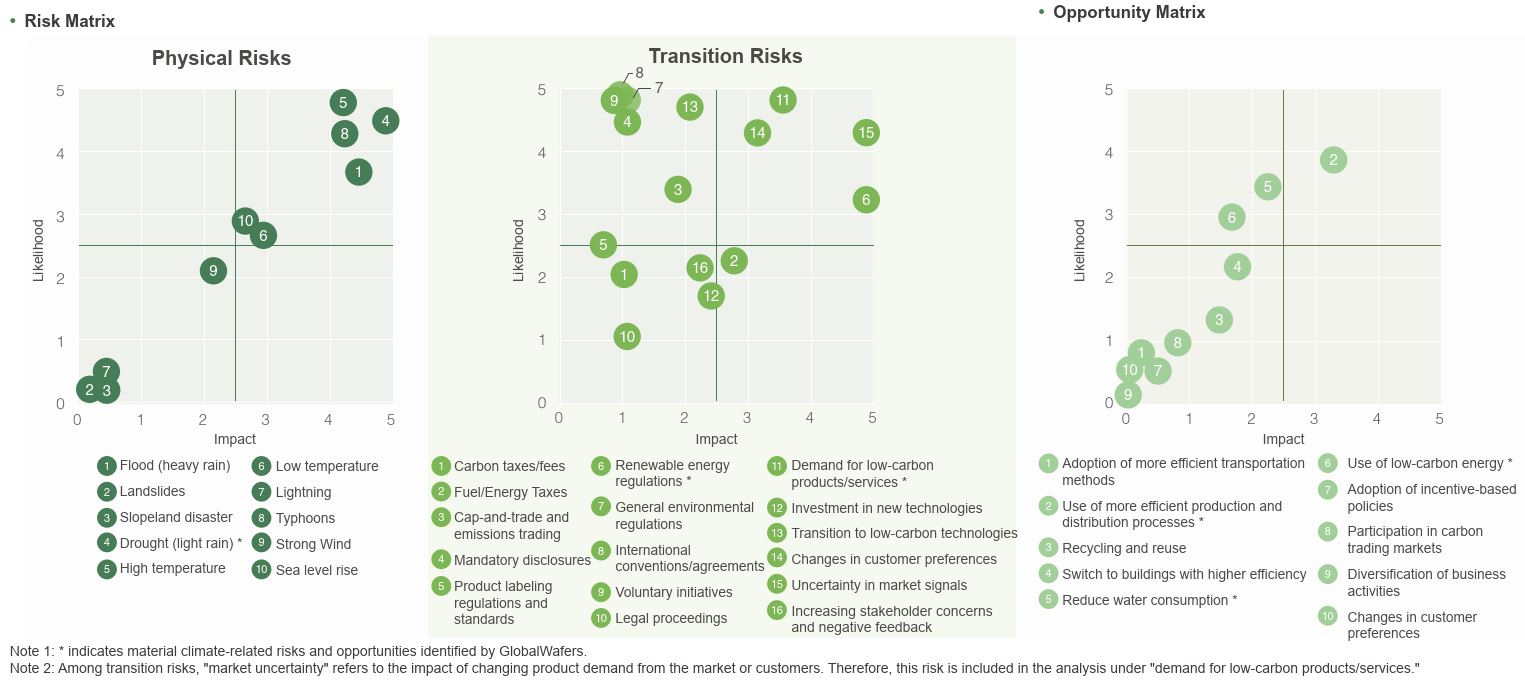

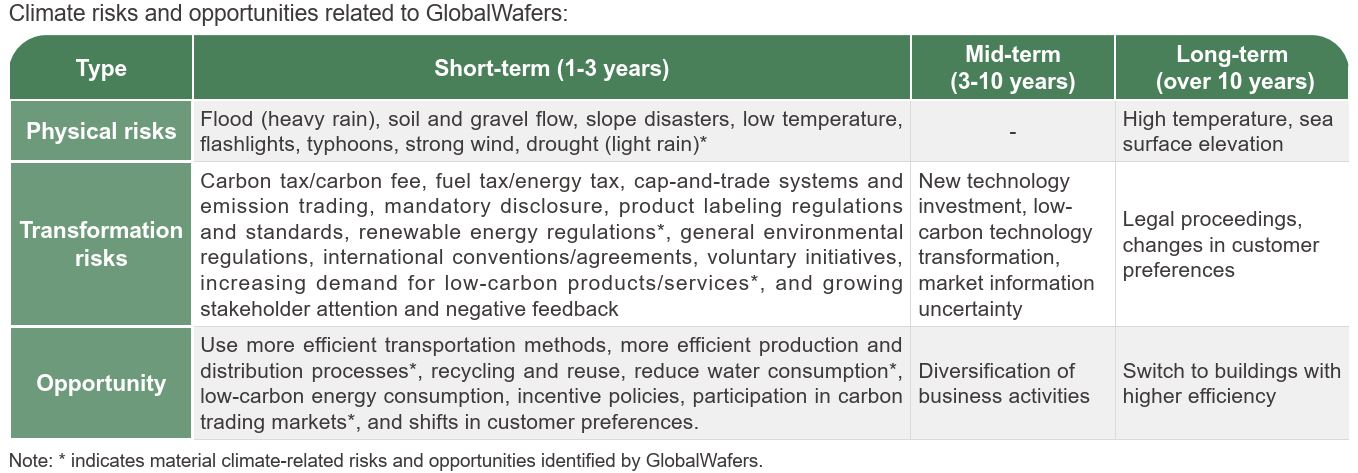

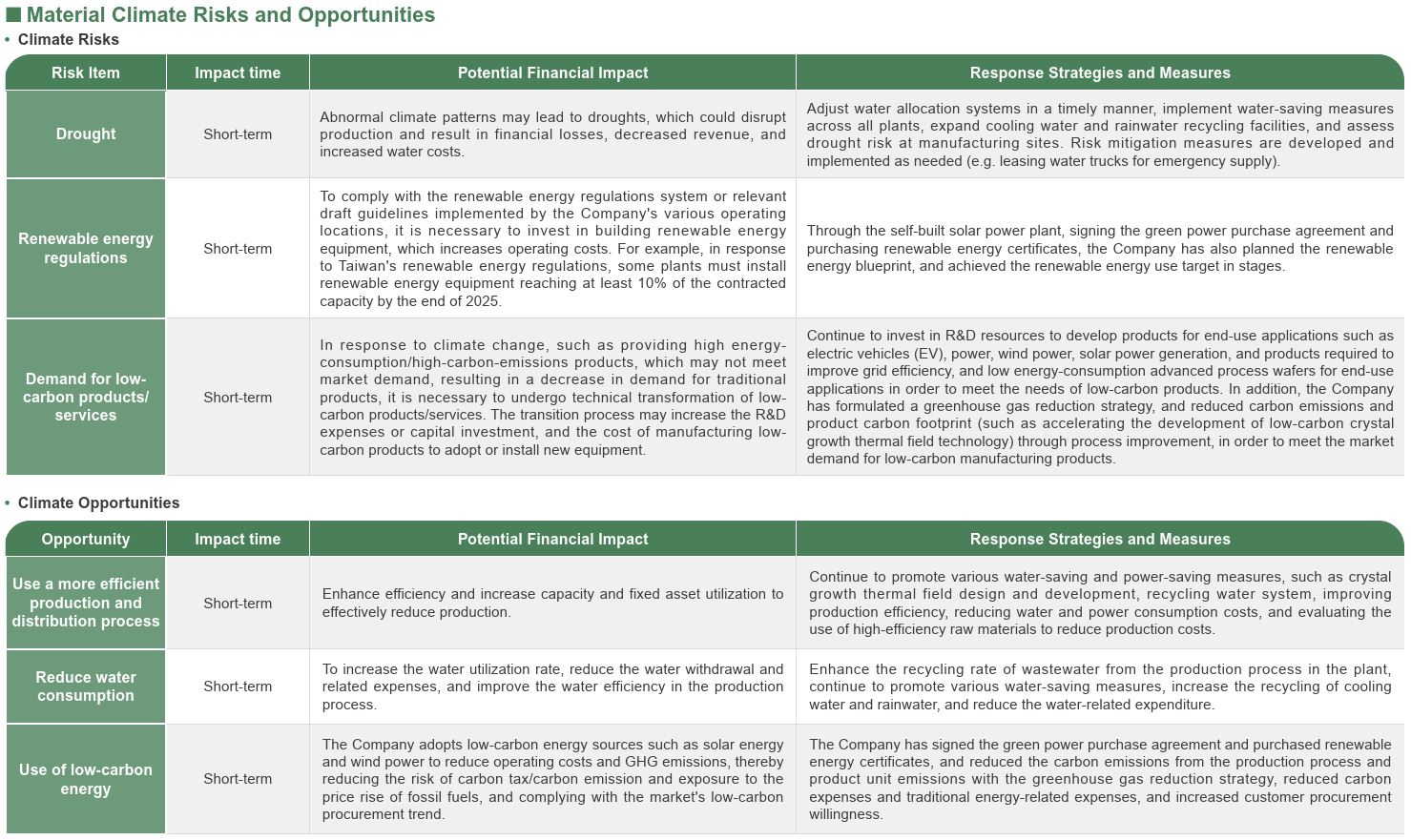

With the intensifying impacts of climate change, GlobalWafers continues to assess and manage related risks and opportunities to mitigate potential effects on operations and financial performance. In 2024, we identified 10 physical risks, 16 transition risks, and 10 opportunities, and focused our evaluation on three key risks and three key opportunities with potential financial implications, for which corresponding response strategies were developed. To enhance the transparency of information disclosure, we referred to domestic and international technical reports, regulations, and industry practices, while incorporating insights from internal and external experts. Based on a comprehensive scoring of “magnitude of impact/benefit” and “likelihood of occurrence,” we developed a risk and opportunity matrix to identify and prioritize material issues, thereby strengthening our climate resilience on an ongoing basis.

GlobalWafers defines the timeframes for climate-related risks and opportunities as follows: short-term (1–3 years), medium-term (3–10 years), and long-term (over 10 years). The Company collects and identifies climate-related risks and opportunities relevant to its operations, and focuses on the 3 most significant risks and the 3 most significant opportunities based on their assessed impact. Each identified item is evaluated for its potential financial impact on the Company, and corresponding response strategies and mitigation measures are formulated accordingly.

Climate Change Scenario Analysis

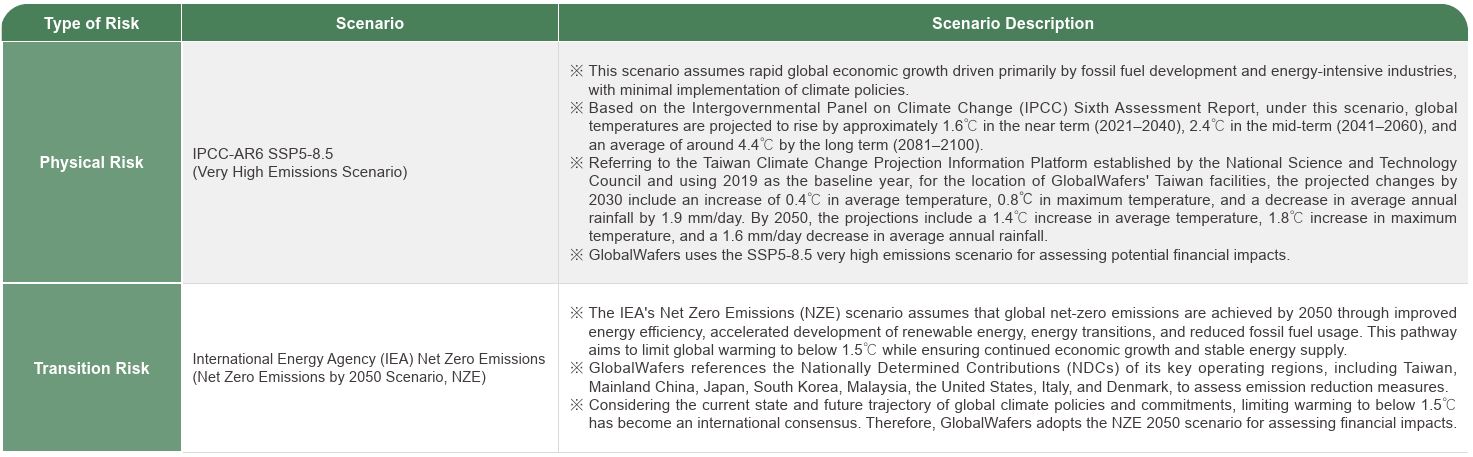

GlobalWafers conducts its climate scenario analysis based on the TCFD framework, referencing the latest scientific assessment reports published by the International Energy Agency (IEA) and the Intergovernmental Panel on Climate Change (IPCC). The Company also incorporates insights from external consultants. Following a comprehensive assessment, the following climate risk scenarios have been adopted.

Transition Actions and Financial Analysis

- Low-Carbon Products

- Renewable Energy Regulations

- Drought

GlobalWafers continues to invest in R&D resources to develop products required for end applications such as electric vehicles (EVs), power systems, wind power, solar power generation, and grid efficiency enhancement, as well as wafers designed for superior energy performance to meet the growing demand for low-carbon products. In addition, its wholly owned subsidiary is dedicated to renewable energy services and technology development, actively investing in the development, construction, and operation of solar power plants. As of the end of 2024, GlobalWafers’ cumulative installed capacity of solar power plants reached 49.7 MW, with an estimated annual generation of 60.3 million kWh, equivalent to a reduction of approximately 29,787 metric tons of carbon emissions each year, which is comparable to the annual carbon absorption of 76 Da’an Forest Parks. In 2024, revenue from sustainable low-carbon products accounted for about 20 percent of total annual revenue.

Note: Figures represent the ratio of financial impacts from risks/transition actions to annual revenue.

Note: Figures represent the ratio of financial impacts from risks/transition actions to annual revenue.

Climate Risk Management and Greenhouse Gas Reduction Strategy

The Company continues to pay attention to climate change adaptation and control, and integrates climate change issues into the Company’s overall risk management through regular risk identification, measurement, monitoring, reporting and response risk management procedures. To implement the risk management mechanism, the Sustainability Development Committee regularly reports (once a year) to the board of directors and the Audit Committee (composed of 4 independent directors) on the Company’s operations-related environmental, social, and corporate governance issues and risk issues, and the relevant response strategies, management operations, and implementation status. Given the importance and uniqueness of the climate change issues, the Sustainability Development Committee also provides quarterly reports to the board of directors on environmental indicator performance and targets, climate change response and management, and other related matters.

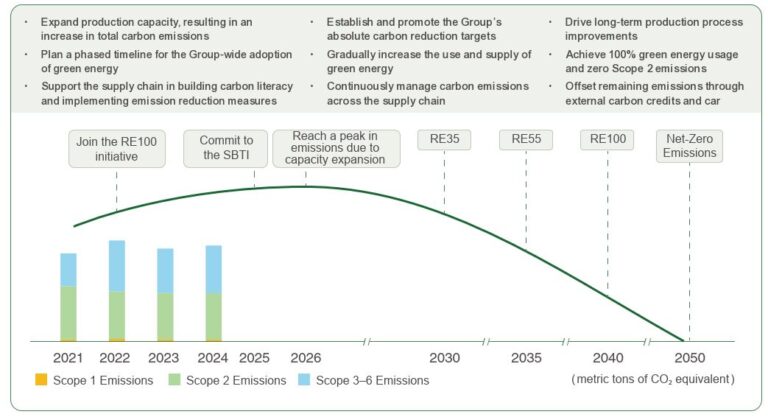

GlobalWafers Decarbonization Roadmap

To address physical risks, GlobalWafers incorporates climate-related physical risk considerations into its adaptation strategies by conducting simulation drills and training programs focused on the potential impacts of climate change on the Company’s assets. A comprehensive and rigorous set of preventive measures and emergency response plans has been established. In the event of a crisis or disaster, the Company promptly initiates the most appropriate response and recovery plans to minimize uncertainty and potential impacts to the greatest extent possible.

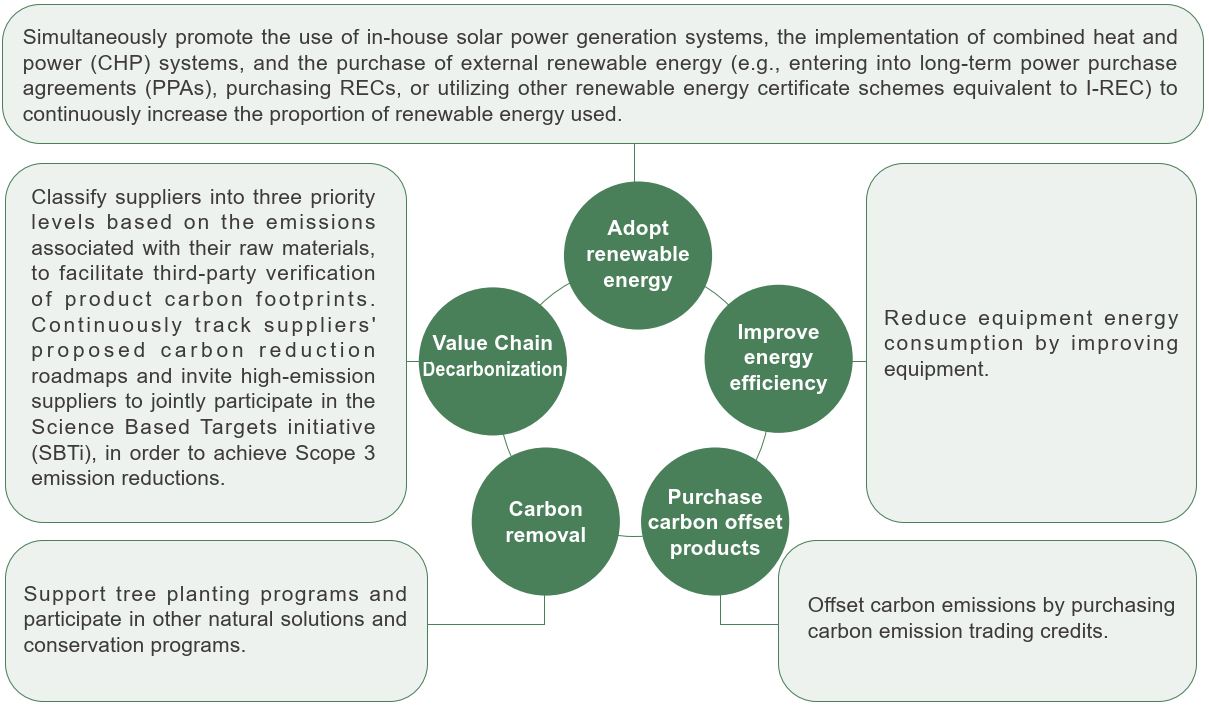

In response to transition risks, GlobalWafers has established a greenhouse gas policy and implements various reduction initiatives. Using 2019 as the baseline year, the Company has set short-, medium-, and long-term carbon reduction targets and continues to drive greenhouse gas emission reduction efforts. like the factors above, the main source of greenhouse gas emissions of the Company is Scope 2, so the greenhouse gas emission reduction strategy is to reduce the carbon emissions of Scope 2. To achieve greenhouse gas reduction, the following strategies have been formulated:

Key Strategies and Targets for Climate-Related Risks and Opportunities